Capitalism

Dr. Susmit Kumar

Dr. Susmit Kumar

Modern capitalism has become a business-government joint venture in which large corporations and wealthy people have hijacked democracy. All politicians (even Democrats, who claim to work for the poor) have to take money from them in order to win elections because of the ballooning costs of running a successful election campaign. Once they accept donations, they are obligated to work for their benefactors. If they are already wealthy, in turn, they have a good chance of buying a Senate seat or major-city mayoral post. It may be for this reason that half of the Senate is composed of millionaires. After leaving Capitol Hill, most congressmen work for lobbying organizations, on Wall Street, or for multinationals.

Money plays an important role in the political process of almost all other democratic countries as well. In Britain, Prime Minister Tony Blair and his team were accused of selling honors such as peerages and knighthoods in return for loans and donations to the Labour Party. The opposition Conservative Party and Liberal Democrats too have done this in past. Scotland Yard began an investigation when the issue of selling honors was raised in the British press and a Scottish Nationalist member of Parliament complained that the Labour Party had broken the 1925 Honours (Preventions of Abuses) Act. Their investigation resulted in the arrest of a couple of Labour Party functionaries, including Ruth Turner, Blair’s director of government operations at 10 Downing Street. Blair himself was questioned, too.

In Thailand, billionaire Thaksin Shinawatra founded a political party in 1999 and became prime minister after a landslide election victory in 2001. He was reelected in 2005, but was ousted in a coup in 2006 because of corruption allegations against him. Similar is the story of Silvio Berlusconi, an Italian billionaire. Although Mr. Berlusconi was not ousted in a coup, he was defeated in the general elections, and had several corruption charges against him. The list of millionaires and billionaires becoming government officials is now increasing. They are not going to work for the common people, however.

The corruption of politics is an ancient problem. In order to stop the meddling of businessmen in political affairs, Chanakya (350-283 B.C.) more than 2,000 years ago wrote,

A businessman becoming excessively rich is a menace to the state. Should the king allow anyone to become too wealthy, let him reduce the bulk of his wealth and property through various kinds of direct and indirect taxes, or else, trying to acquire control of the state as a tool for their rapacious exploitation, these Vaeshyas [capitalists] may upset the whole governmental machinery.41

Chanakya was adviser and prime minister to the first Maurya emperor, Chandragupta (340-293 B.C.), in India, and architect of his rise to power. He was also known as Kautilya, wrote a political treatise called Arthashastra, and is considered “the world’s pioneer economist” and “the Indian Machiavelli.”

In the name of small government and tax breaks, Republican administrations led by Reagan and Bush, Jr., have benefited the richest the most. The top 0.1 percent of income earners—the top one-thousandth—numbers about 145,000 taxpayers, each with at least $1.6 million in income and often much more. Their income was at least $3 million in 2002, two and a half times the $1.2 million, adjusted for inflation, that group reported in 1980. No other income group rose nearly as fast in earnings. The share of the nation’s income earned by those in this category has more than doubled since 1980, to 7.4 percent in 2002. The share of income earned by the rest of the top 10 percent rose far less, and the share earned by the bottom 90 percent fell.42

From 1950 to 1970, for example, for every additional dollar earned by the bottom 90 percent, those in the top 0.01 percent (about 14,000 households, each with $5.5 million or more in income in 2004) earned an additional $162, according to a New York Times analysis. From 1990 to 2002, for every extra dollar earned by those in the bottom 90 percent, each taxpayer at the top brought in an extra $18,000.43

American working families have seen little if any economic progress over the last 30 years. Adjusted for inflation, median family income doubled between 1947 and 1973. But it rose only 22 percent from 1973 to 2003, largely as a result of wives entering the paid labor force or working longer hours, not rising wages. Meanwhile, economic security is a thing of the past: Year-to-year fluctuations in the incomes of working families are far larger than they were a generation ago. All it takes is a bit of bad luck in employment or health to plunge a family that seems solidly middle class into poverty. The wealthy have done very well, however: Since 1973 the average income of the top one percent of Americans has doubled, and the income of the top 0.1 percent has tripled.44

According to economist Paul Krugman, middle-class America was created by what has been called the “Great Compression” of incomes that took place during World War II, and was sustained for a generation by social norms that favored equality, strong labor unions, and progressive taxation. But since the 1970s, all of those sustaining forces have lost their power.45

The situation is more or less similar in other countries. In 1995, the richest one percent of Australians had five percent of the national income; this rose to nine percent in 2005, a period of just 10 years.46 As noted earlier, the 36 richest men and women in Russia were worth about $110 billion, or 24 percent percent of the nation’s GDP, according to 2004 data.47 Surpassing Bill Gates, Mexico’s Carlos Slim has become the world’s richest man, now worth $67.8 billion, even though 53 percent of Mexico’s population lives in poverty.48 The richest two percent of adults own more than half the world’s wealth. The richest 10 percent of adults own 85 percent of world assets. The bottom 50 percent of the world’s adults own barely one percent of global wealth.49

Apart from getting puppets elected as leaders, big corporations spend money via lobbying firms, also known as “K Street” in Washington terminology, to buy congressional votes for their pet projects; the ultimate losers are ordinary citizens. Medical insurance costs are an example of this influence. Because of the large amounts of money spent by medical insurance and drug firms on lobbying, Congress has failed to pass a comprehensive medical insurance plan, as a result of which medical costs rise exponentially every year.

According to a survey by the Kaiser Family Foundation and the Health Research Educational Trust published in 2005, the average cost of health insurance for a family of four had soared past $10,800, exceeding the annual income of a minimum-wage earner. Between 2000 and 2005, premiums have gone up 73 percent, while wages have grown only 15 percent. The rising costs are forcing many businesses, especially smaller companies, to stop offering coverage, and are causing some employees who can no longer afford insurance at work to buy it on their own—or go without.50 Between 2001 and 2006, health costs rose 78 percent, more than four times the pace of prices and wages. In 2006, the total average annual cost for family coverage premiums rose to $12,106.51 About 45 million Americans are medically uninsured.

Retirement health plans are undergoing a similar slashing. By 2005, only a third of American companies with 200 workers or more offered any health care benefits to their retirees, down from 66 percent in 1988. The companies that still offer retirees health insurance have been trimming their plans in many ways—higher premium contributions from retirees, increased co-payments, and increased deductibles.52

By 2015, health care spending will jump from the 16.2 percent of the economy it absorbs now to 20 percent; i.e., one out of every five dollars spent will go to health care. The sector will become as large as the entire manufacturing sector, which is about 20 percent of the economy. This expansion will drive more and more people into the ranks of the uninsured.

Half of American bankruptcy is due to medical bills and illnesses. “Unless you’re Bill Gates, you’re just one serious illness away from bankruptcy,” said Dr. David Hammelstein, lead author of a 2005 study about medical causes of bankruptcy and associate professor of medicine at Harvard University. “Most of the medically bankrupt were average Americans who happened to get sick. Health insurance offered little protection.” The study found that the majority of medical bankruptcy filers were middle-class homeowners with some college education. They usually had health insurance, too. More than 75 percent of the people in medical bankruptcy were insured when they first got sick. The study’s findings are especially troubling as more Americans get their coverage from consumer-driven health insurance plans that can carry large deductibles, leaving them vulnerable to hefty medical expenses. Among those whose illnesses have led to bankruptcy, out-of-pocket medical costs averaged $11,864. A diagnosis of cancer cost the average patient $35, 878.53

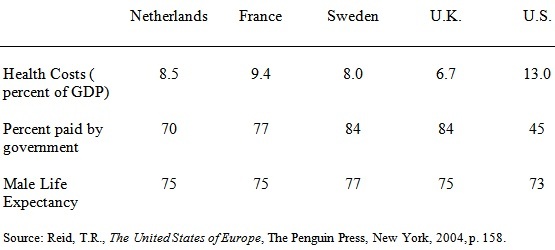

Although expenditure on health is one of the highest among the Organisation for Economic Co-operation and Development (OECD) countries (Table 8.1), the quality of care is average, if not among the lowest.

Table 8.1 (Data based on 2001-2002)

The U.S. has been slipping in international rankings of life expectancy for decades. In 2004, it ranked 42nd, down from 11th two decades earlier, according to international data provided by the Census Bureau and domestic data from the National Center for Health Statistics. Countries that surpass the U.S. include Japan and most of Europe, as well as Jordan, Guam, and the Cayman Islands. Dr. Christopher Murray, head of the Institute for Health Metrics and Evaluation at the University of Washington, said, “Something’s wrong here when one of the richest countries in the world, the one that spends the most on health care, is not able to keep up with other countries.” A major reason is that 45 million Americans lack health insurance.54

In most European countries, including Britain, when a person loses a job, he gets benefits for housing, food, child care, heat and light, a monthly unemployment payment, as well as access to the public health care system. When a person in the U.S. loses a job, however, he loses his health insurance, too—at a time when he needs it the most. Similarly, when a child is born in most European nations, parents get monthly support checks from the government and paid time off from work for several months, whereas in the U.S., firms would prefer not to retain a woman who has a newborn.

According to a large international study published in the May 2006 Journal of the American Medical Association, middle-aged English people are “much healthier” than their American counterparts, even though the U.S. spends far more on medical care than the U.K. Americans have significantly higher rates of diabetes, heart disease, stroke, lung disease, and cancer than English people in the 55-to-64 age group. The researchers noted that the U.S. spends $5,274 per head on medical care while the U.K. spends only $2,164, adjusted for purchasing power. But Britain’s National Health Service provides publicly funded medicine for everyone, while Americans under the age of 65 rely on private insurance.55